At CaixaBank, we offer a wide variety of cards, so you can choose the one that best suits your financial needs.

FAQs about bank cards

At CaixaBank, we offer a wide variety of cards, so you can choose the one that best suits your financial needs.

In the following video we explain how and when to use a credit card with the end-of-month payment method or changing it to deferred payment:

We explain each type of card and its particular characteristics to help you decide:

We're talking about the different types of bank cards, what they're best used for and some security tips.

End-of-month payments

Payment in 2 days

Deferred payment (revolving)

A credit card with an end-of-month payment modality involves you paying off the credit you used for your purchases at the end of the agreed settlement period (e.g. at the end of the month, if you choose the monthly settlement period). You will not have to pay interest for this.

This will be the default payment method for cards with the end-of-month payment modality (such as the Visa Classic).

Let us give you an example: John takes a weekend getaway with his friends on Friday, 14 April. He decides to use his credit card to rent a car and invites his friends to dinner. The credit card is used as a guarantee for the car rental and is also used to pay for dinner. This dinner was purchased on credit, meaning he doesn't need to spend the balance in his account on the actual day of the dinner with his friends. John will start to pay back the money spent on the dinner without interest from 1 May. We will charge it to the account associated with the card.

The card also allows other payment methods that you must expressly request, such as deferred payment of all the credit you have on a monthly basis, or payment in instalments of a certain transaction or purchase. These two payment methods do require interest payments, which are specified both in the pre-contractual information (INE) and in the contract.

Deferred payment consists of putting off (or deferring) the repayments for the credit you spend through the payment of a monthly instalment, instead of paying the total amount at the end of the agreed settlement period. This way you decide what monthly instalment you want to make to repay the credit drawn down. Even if you spend more credit each month than the chosen instalment, you will only pay the chosen instalment, provided that it respects the minimum instalment limit established at any given time by CaixaBank Payments & Consumer so that the repayment of your debt is not dragged out excessively. When choosing the level of the monthly instalment you want to pay, bear in mind that the higher the monthly instalment you pay, the lower the total cost of the credit to be repaid, because you will repay the loaned credit sooner. All credit cards allow you to activate this payment method if you need it. Only one comes with this payment method activated by default without the possibility of changing it, namely the deferred payment card (Visa&Go).

Let us give you another example: John's washing machine breaks down in December, just when he is focused on finishing his Christmas shopping and celebrating with friends and family. He expects an increase in expenses of around €1500, which he will not be able to pay all at once at the end of the month because he would run out of credit at the beginning of the following month. Instead, John chooses to modify the payment method for his credit card to deferred payment, choosing to pay a monthly amount of €150 for the reimbursement of the credit. If he doesn't spend anything more with his credit card, he will end up paying off his debt in a little less than a year, including associated interest. Each instalment includes part of the capital drawn down that John has to repay + part of the associated interest. If he increases the monthly instalment, he will pay off the debt faster. When you pay off the debt faster, you also pay less interest.

To calculate your monthly instalment, you can go to the Bank of Spain's banking customer website where they provide a calculator to figure out how much interest you would pay and when you would end up paying off the debt under one or another level of monthly instalment: https://clientebancario.bde.es/pcb/es/menu-horizontal/podemosayudarte/simuladores/calculo_cuota_tarjeta_revolving.html

Payment in instalments consists of paying for a certain purchase or transaction on credit and instead of paying for it all at the end of the month interest-free, you pay it off over the months you decide to split it over, including associated interest or paying a fixed fee, also reflected in the contract.

Let us give you an example: John wants to buy the latest model smartphone but it costs €1,000, so he doesn't want to pay for it with his end-of-month credit card, as he would have to pay it all off at the end of the month and would be left with nothing in his account. John can choose to split the payment of the purchase over a number of months (either paying associated interest or paying a fee). He selects the term over which he wants to pay back the credit and, in this way, pays the purchase price + the associated interest divided over the months selected for repayment.

The maintenance fee for the Visa Classic is €48/year. Other cards with the end-of-month payment modality may have different maintenance fees, which, if applicable, will be specified during the contractual process.

To be as transparent as possible with you and to let you know how our end-of-month card works before you even start the contracting process, we provide you with an example of the pre-contractual information document (INE) and an example of the contract, which we attach below.

PLEASE NOTE: The NIR and APR numbers that you will see in both the example INE and the example contract are specific to the EXAMPLES and therefore may not be those that we will finally apply to your card, as these conditions in the examples are the maximum applicable. We provide the maximum values for these numbers because, as you have not started the contracting process, we have not been able to study your financial situation, so we cannot tell you in advance what financial conditions you will have on your card. For this reason, we prefer to show you the maximum rates.

We also have a credit card with 2-day payment, combining the best of debit and credit. The 2-day payment lets you buy on credit while shortening the settlement period to 48 hours. This way, everything you spend is reflected in your card transactions right away, but it is debited from the associated account in 48 hours. This payment method lets you recover your card's credit limit quickly so you can continue your day-to-day purchases.

This will be the default payment method for cards with 2-day payment (such as Visa &Pay and Visa MyCard).

You also have the option to customise the payment day and instead of paying the credit in 48h, paying it weekly, monthly or as often as you specify (example: once you have spent €200). You will not have to pay interest in any of these cases, since you will return the full amount of the credit drawn down at the end of the agreed settlement period.

This card also lets you use the balance in your account (up to €3,000) once you use up your credit, as long as the associated account where you have the balance is with CaixaBank, and you have sufficient balance to cover both the credit limit you have used up and anything you want to spend over that limit.

Here's an example: Juan uses the card with 2-day payment for everyday purchases. On 10 April, he uses the card to pay €12 for the transport card, on 11 April he spends €6.90 on a salad and on 15 April €25.90 at the supermarket. Juan will see each of these card transactions in the app or CaixaBank Now as soon as they are made, and has to pay back the credit used, with no interest, as follows: €12 on 12 April, €6.90 on 13 April and €25.90 on 17 April.

And an example to understand how to use the balance in the account in addition to using the credit: Juan has a balance of €200 in his CaixaBank account associated with the card, and the credit limit on the card is €100. If he needs to make a purchase for €150, he can do so because he will charge €100 to his card (which he will pay in 48h) and €50 will be paid directly from his account balance at the time of purchase.

The card also allows other payment methods that you must expressly request, such as deferred payment of all the credit you have on a monthly basis, or payment in instalments of a certain transaction or purchase. These two payment methods do require interest payments, which are specified both in the pre-contractual information (INE) and in the contract.

A deferred payment consists of paying back the credit you spend gradually, instead of paying the total amount at the end of the agreed settlement period. This way, you decide what monthly instalment you want to make to pay back the credit used. Even if you use more credit each month than the chosen instalment, you will only pay the chosen instalment, provided that the amount paid back is the minimum specified by CaixaBank Payments & Consumer to ensure your debt is repaid in a timely manner. When choosing the level of the monthly instalment you want to pay, bear in mind that the higher the monthly instalment you pay, the lower the total cost of the credit to be repaid, because you will repay the loaned credit sooner.

Paying in instalments consists of paying for a certain purchase or transaction on credit and instead of paying it all back at the end of the month interest-free, you pay it off over however many months you decide, including the associated interest or a fixed fee, also reflected in the contract.

To be as transparent as possible with you and to let you know how our 2-day payment card works before you even start the application process, we provide you with an example of the pre-contractual information document (INE) and an example of the contract, which we attach below.

PLEASE NOTE: the NIR and APR numbers that you will see in both the INE example and the sample contract are specific to the EXAMPLE and therefore may not be those that we will apply to your card, as these conditions in the examples are the maximum applicable. We provide the maximum values for these numbers because, as you have not started the contracting process, we have not been able to study your financial situation, so we cannot tell you in advance what financial conditions you will have on your card. For this reason, we prefer to show you the maximum rates.

The maintenance fee for the Visa&Pay and MyCard is €48.

To be as transparent as possible with you and to let you know how our end-of-month card worksbefore you even start the contracting process, we provide you with an example of the pre-contractual information document (INE) and an example of the contract, which we attach below.

PLEASE NOTE: The NIR and AER numbers that you will see in both the example INE and the example contract are specific to the EXAMPLES and therefore may not be those that we will finally apply to your card, as these conditions in the examples are the maximum applicable. This is the case because, as you have not started the contracting process, we have not been able to study your financial situation, so we cannot tell you in advance what financial conditions you will have on your card. For this reason, we prefer to show you the maximum rates.

A credit card is a payment instrument (you use it to pay) and it is also a credit facility (financing we make available that you can use to pay for something at the time of purchase). When paying with a credit card, you do not pay for purchases with your account balance on the spot, but rather pay the total amount you have spent during the agreed period (usually one month) at the end of this period (usually at the beginning of the following month). You will not have to pay interest for this.

If the card offers deferred payments, or is payable at the end of the month but you use it with the deferred payment method, then, contrary to the above, you will not pay the total credit spent at the end of the agreed period; instead, you will pay it in monthly instalments that are used to pay down the credit used gradually, with interest accruing from the time you use the credit until it is paid in full.

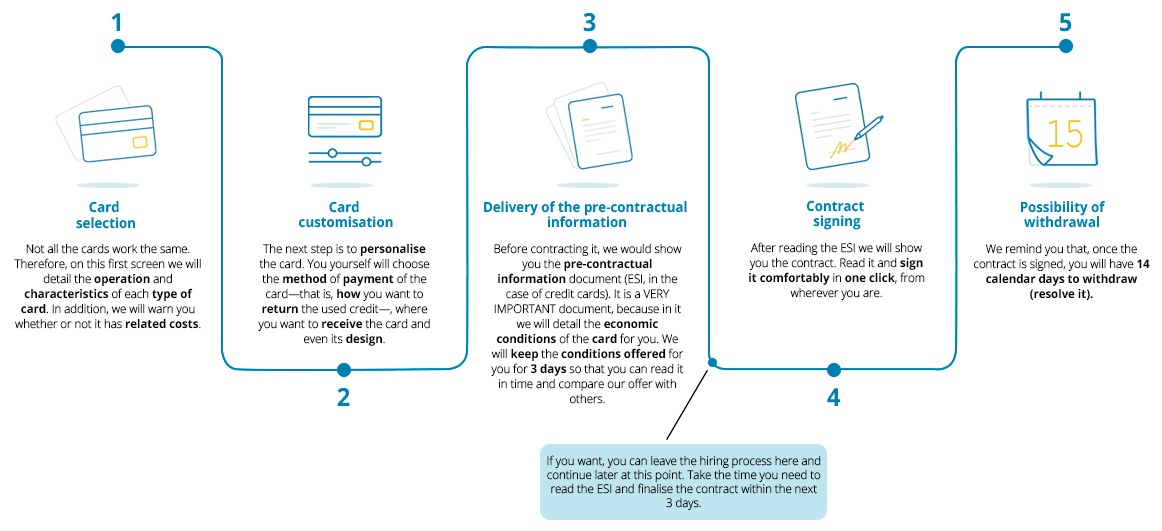

Before you take out the card, CaixaBank will give you (during the application flow process, and also through the Now digital banking service as well as through email) the pre-contractual information (INE for credit cards) for the card contract you choose before we show you the contract. It is important that you read the document carefully and, if you want, compare it with offers from other banks. This document describes important financial conditions that you should know about the card, as well as other relevant information about the card contract (such as the right of withdrawal, the payment methods of the card, your assigned credit limit, etc.). Take your time to read it. We will honour the conditions offered for 3 days so that you can sign the contract once you have thought about it and decided if the product is right for you.

Therefore, before you sign up for the card, you have the right to:

Receive suitable and sufficient information on the product you are going to take out.

Receive pre-contractual information (SECCI, in the case of a credit card) prior to signing the contract in a durable medium.

Take your time to decide whether you want to sign up for the card, once you know the applicable financial conditions (detailed in the SECCI). We will honour the financial conditions detailed in the SECCI for 3 days.

Yes. You can view your card purchases at any time through the CaixaBankNow digital banking service, either on the app or website, and at ATMs.

You will also receive a monthly statement from CaixaBankNow digital banking detailing the card transactions, regardless of the card payment method.

Transactions made with an end-of-month card will be charged to your account at the end of the agreed settlement period in a single charge for the total amount of the transactions.

Transactions made using a 2-day card are charged individually to your account 48h after each purchase.

Transactions made with a deferred payment card are charged gradually through the monthly instalment selected.

Yes. You have 14 calendar days to withdraw from the card contract. You do not have to provide a reason. Once you ask to withdraw, we will cancel the card in 24h, and deem the contract terminated. If you have used the card and have not paid back the credit used, you will have 30 calendar days to do so, together with any interest that may apply.

After the first 14 days, you will be able to cancel the contract unilaterally at any time, without providing a reason, although you will first have to pay any amounts you may owe. As soon as you request it, provided there is no outstanding debt, we will cancel the contract in 24h.

You can request to withdraw from or cancel the contract by the following means:

To request it through CaixaBankNow, you have to follow these steps:

Yes, a copy of the contract will be provided to you. It will be available in the Documents and Contracts section of CaixaBankNow so you can read, download and print it whenever you want. If you do not have CaixaBankNow, we will send it to your email address.

We want to be able to always stay in touch with you and communicate quickly and seamlessly. To this end, the contract specifies that we will communicate online: we will send you operational notifications (for example, involving changes to the conditions, security or periodic communications, such as monthly statements) primarily through CaixaBankNow digital banking and email. We may also send certain notifications to your cell phone via SMS and/or PUSH messages (provided you have notifications from the CaixaBankNow app enabled) when you need to receive the information as soon as possible (for example, fraud alerts or card blocks that we must communicate to you immediately).

If you want us to continue sending you paper notifications, you can ask us expressly, but keep in mind that we may charge you €0.50 per letter if we use this method.

A credit card with which you repay the amount of credit you have spent via monthly instalments in the amount you choose, with the associated interest. This amount must be at least equal to a minimum amount stipulated by CaixaBank to ensure that repayment is not excessively drawn out over time. Bear in mind that the higher the monthly instalment you pay, the lower the total cost of the credit to be repaid, because you will repay the loaned credit sooner.

Yes. We will keep the financial conditions offered to you for three days.

You can obtain more information about cards by accessing these useful links: